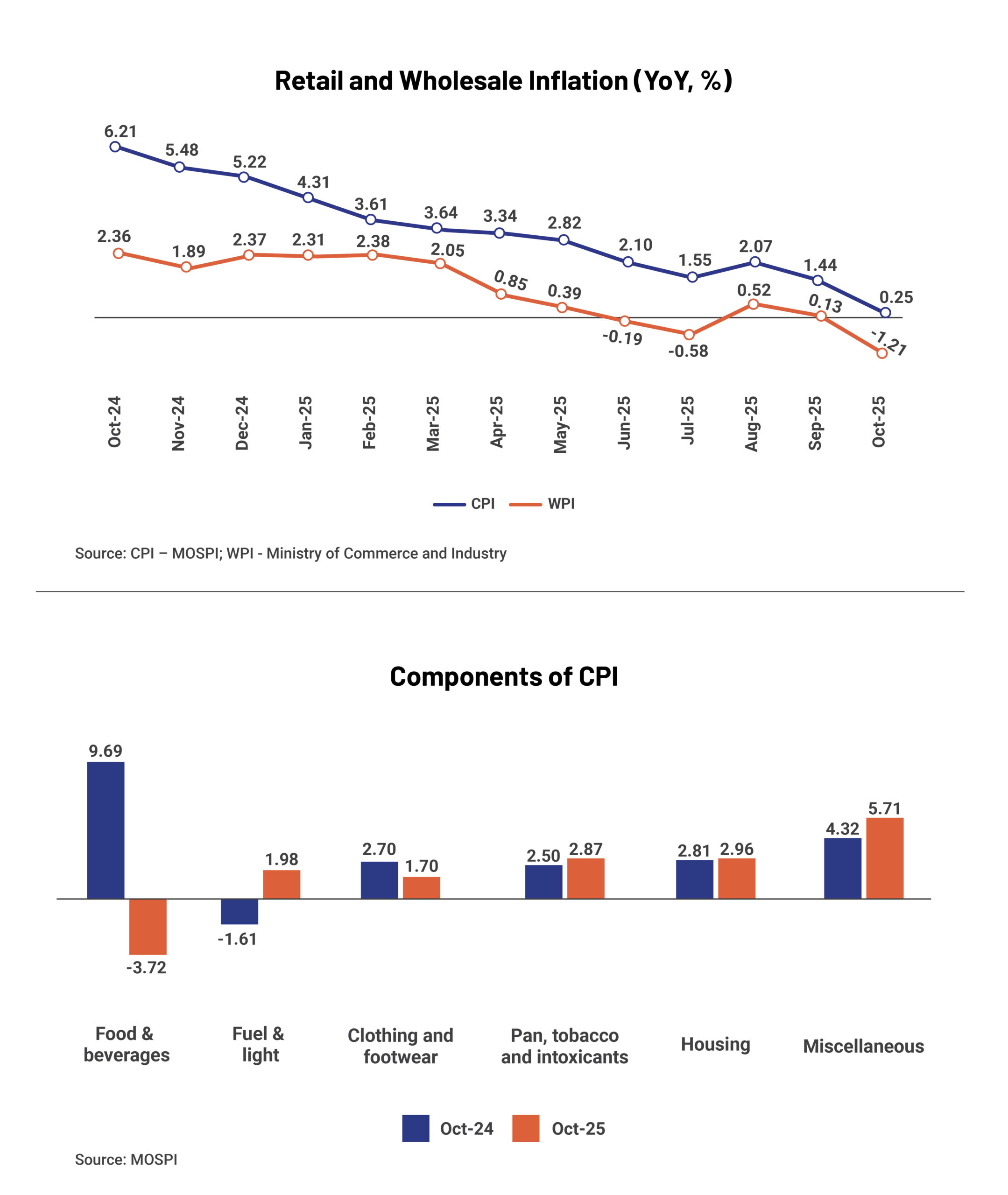

Retail inflation in India falls to over 13-year low, wholesale inflation turns negative

India’s retail inflation, which is measured by the change in the Consumer Price Index, (CPI), fell to 0.25% in October, the lowest level since January 2012. With this, the inflation dropped below the lower end of RBI’s tolerance range of 2%-6% for the third time in this fiscal year. The lower prints led the average inflation for April-October this year falling to 1.9% from 4.7% in the same period last year.

The fall in retail inflation can be attributed to subdued food inflation caused by a favourable base effect (-5.02% in October 2025 versus 9.7% in October 2024). The prices of vegetables and pulses significantly cooled during the month by -27.57% vs. 42.18% in October 2024 and -16.15% vs. 7.43% in October 2024, respectively. Core inflation remained firm at 4.4% during the month. The near-term trajectory of retail inflation is expected to be soft due to relatively stable supply of food, rationalised GST structure, and favourable crude oil dynamics.

Wholesale inflation returned to negative territory after two months at -1.21% in October, dropping to the lowest level since July 2023. Deflation is primarily attributed to a fall in prices of food articles, crude petroleum & natural gas, electricity, mineral oils, and manufacture of basic metals.

Inflation for manufactured products, the largest component in the WPI basket, eased to 1.54% in October from 2.33% in September. The deflation for primary articles segment widened to 6.18% in October from 3.32% in September. Moreover, the fuel and power segment recorded a deflation for the seventh consecutive month at 2.55% in October. Economists expect the near-term wholesale inflation to remain in negative territory, but the contraction is expected to narrow as base effect fades.

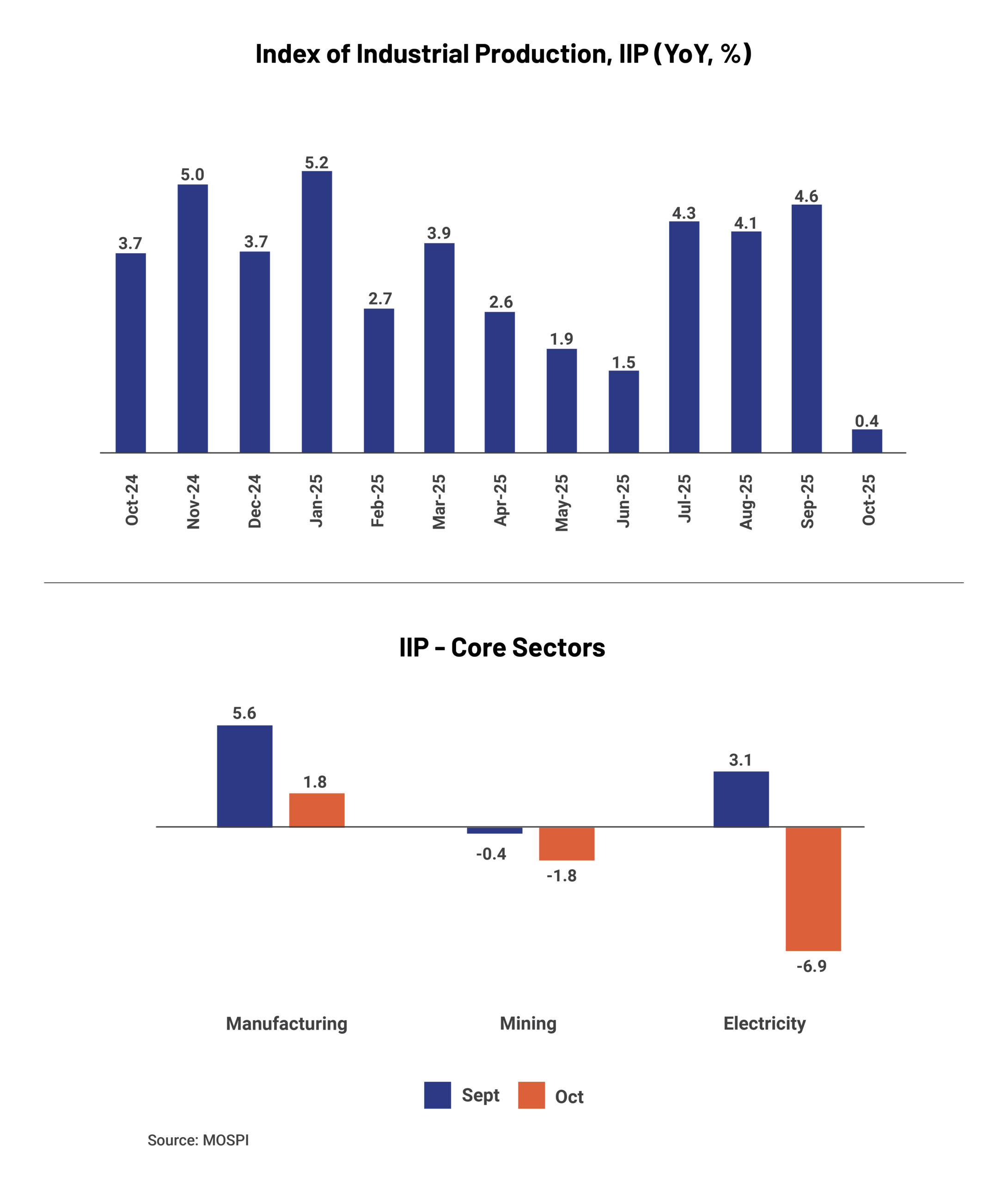

The growth in India’s industrial output, which is measured by the Index of Industrial Production (IIP), plunged to 0.4% YoY in October, the lowest since August 2024, compared to 4.6% YoY in September. This can be attributed to lower workings days on account of festive holidays, extended rainfall, and the impact of US tariffs on exports. With this, the average IIP growth for FY26 till date stood at 2.7%, compared to 4% in the same period last financial year.

All the three production-based segments recorded a moderation in growth during the month. The growth in manufacturing sector output, the largest in the IIP basket, fell sharply to 1.8% YoY in October from 5.6% YoY in September. Within the segment, 9 of 23 industry groups recorded positive YoY growth. Mining sector output contracted for the second consecutive month by 1.8% in October, while electricity output declined sharply by 6.9% driven by unseasonal rainfall in the month.

As per the use-based classification, all the six sub-segments witnessed a slowdown in October. Consumer non-durables continued to decline, registering a steeper contraction of 4.4% in October. Similar sluggishness was also evident in capital goods (2.4% in October vs. 5.4%), intermediate goods (0.9% vs. 6.3%) and infrastructure goods (7.1% vs. 10.6%). Primary goods and consumer durables contracted 0.6% and 0.5%, respectively in the reported month.

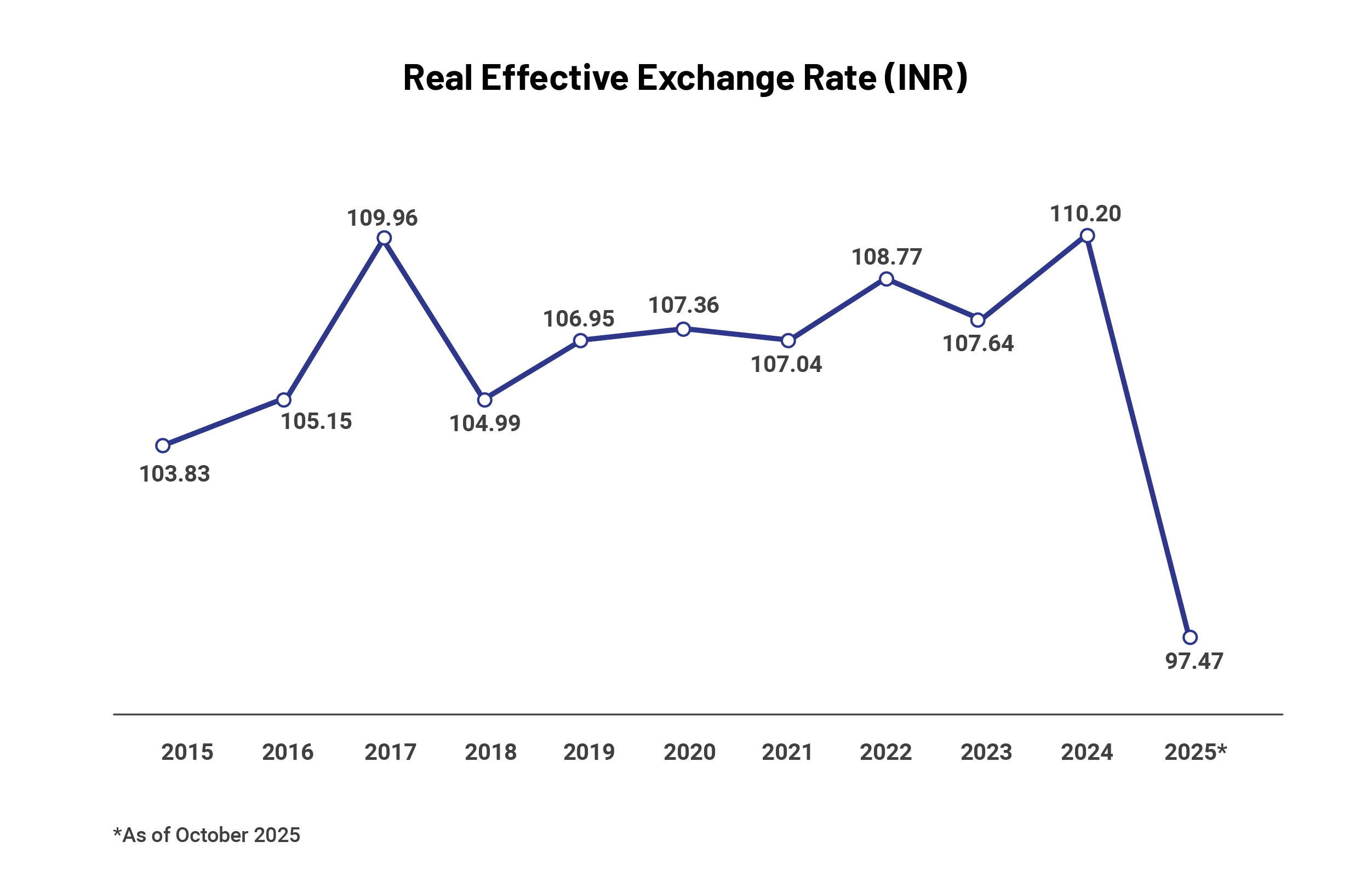

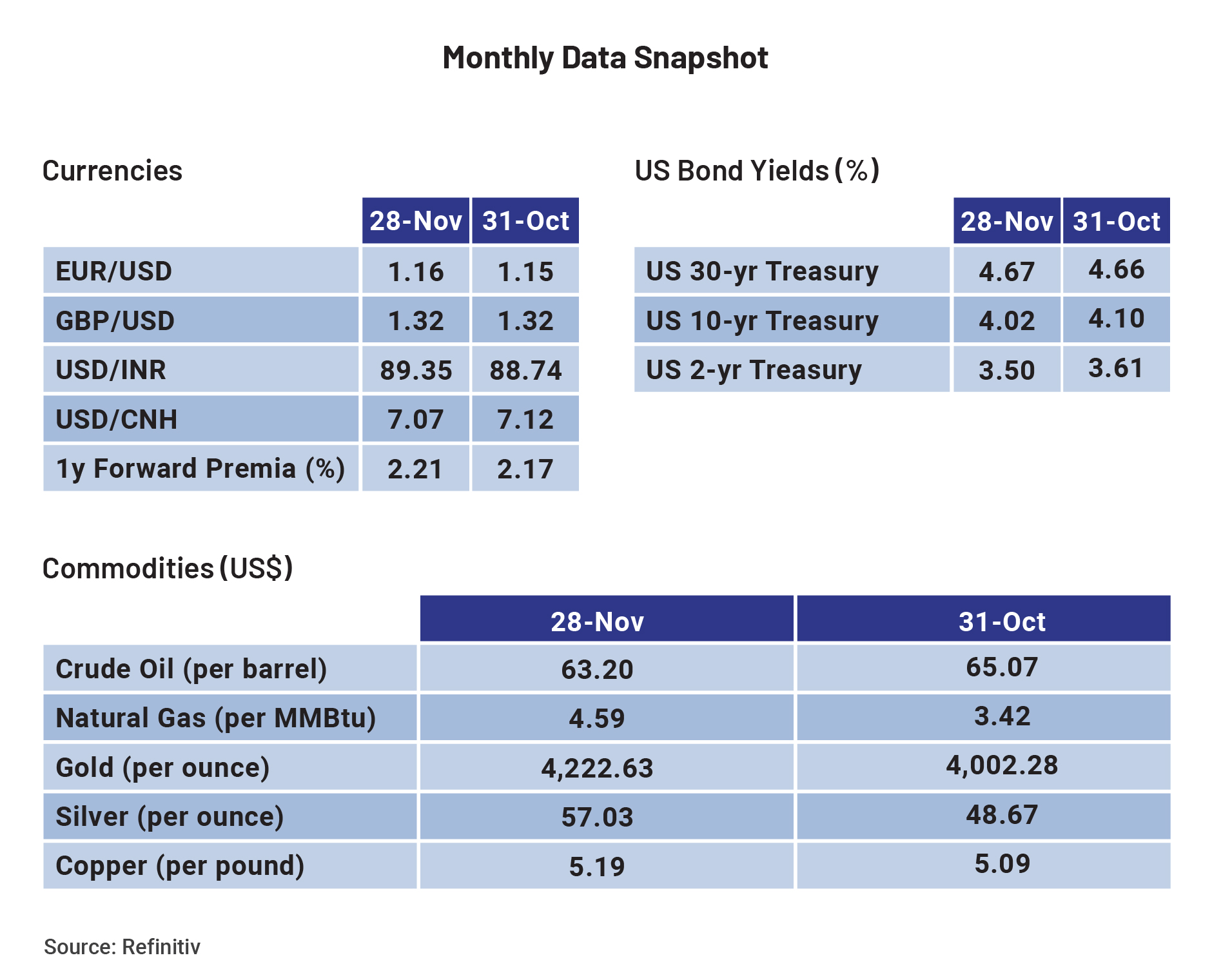

The Indian rupee ended up as the worst-performing currency of 2025 with ~4% year-till November-end fall. The currency continued to hit new all-time lows against the US dollar this year and performed poorly against the Asian peers like the Chinese Yuan, Indonesian Rupiah, and Philippine Peso, among others. The downfall is attributed to multiple factors such as strong demand for the US dollar led by continued capital outflows, higher trade deficit (due to lower shipments to the US), and uncertainty regarding the Indo–US trade deal. The rupee has been hovering close to its record low of 89.49 on November 21, going past the 88.8 levels the Reserve Bank of India had been defending in recent weeks.

Besides the dollar exchange rate, the fall in the rupee can be quantified using the Effective Exchange Rate (EER), which measures the value of the rupee (or any currency) against the weighted average of several foreign currencies divided by a price deflator or index of costs. The Real Effective Exchange Rate (REER), which measures the rupee against a basket of 40 trading-partner currencies, adjusted for inflation, slipped to 97.47 in October, implying the longest stretch of undervaluation in seven years. A REER above 100 denotes overvaluation and below 100 implies undervaluation. Historically, the rupee’s REER tends to stay above 100. It has rarely remained below that threshold for extended periods, which was last recorded in 2016–17.

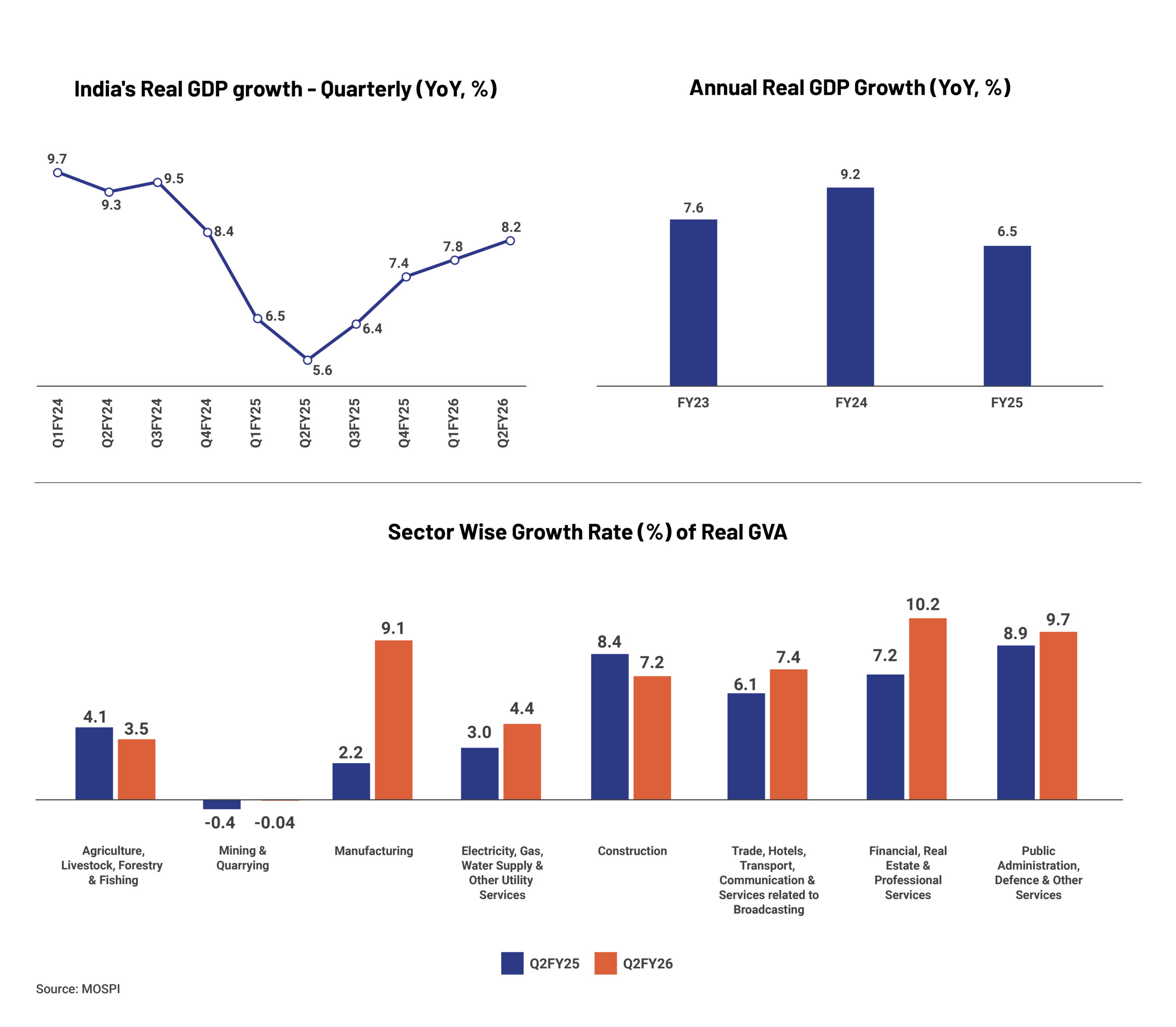

The growth in the domestic economy accelerated to 8.2% in the July-September quarter from 7.8% in the previous quarter and 5.6% in the same quarter a year ago. A strong growth in manufacturing and financial, real estate, and professional services contributed to the overall growth in GDP. The growth in the mining sector remained in the negative territory while the growth in agriculture and construction declined to 3.5% and 7.2%, respectively, in the last quarter from the same quarter of FY25.

As per the expenditure approach in GDP estimates, the growth in Private Final Consumption Expenditure, accounting for ~57% of the economy, quickened to 7.9% from 6.4% in the year-ago quarter. Private investment or the Gross Fixed Capital Formation grew 7.3% compared to 6.7% in the year-ago quarter.

The momentum led economists to revise FY26 growth forecasts upward to 7.4% (on average), which is higher than 6.5% recorded in FY25. The forecast considered the impact of the GST rate cuts since September 22 and festive demand, among other factors. However, some economists warned that the impact of Indo-US trade relations on exports could affect the overall growth.

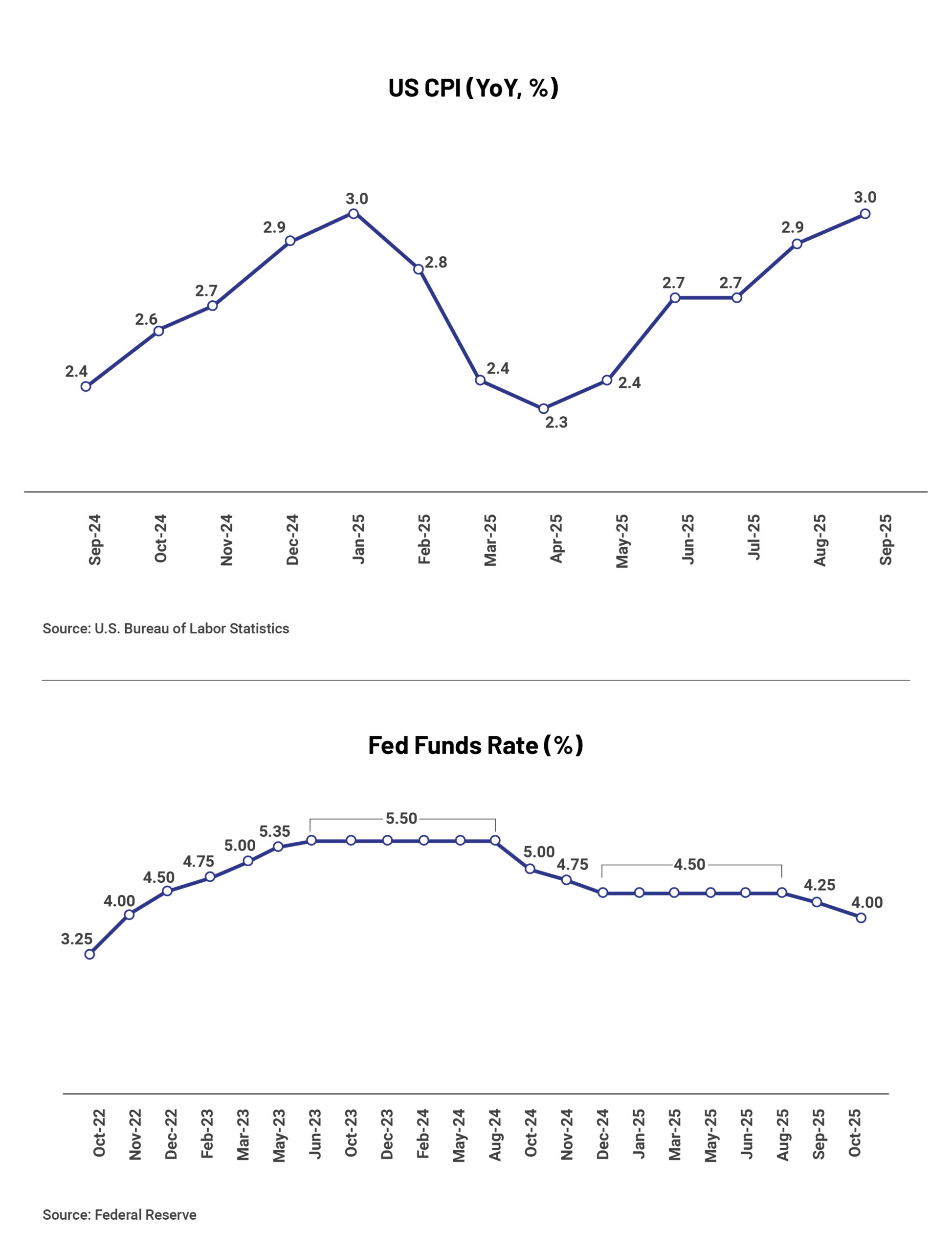

Consumer price inflation in the US flared up to 3% in September but came in a tad below market expectations of 3.1%. This happened as energy prices rose 2.8% YoY, the highest since May 2024, led by fuel oil (4.1% YoY vs -0.5% YoY) and gasoline (-0.5% YoY vs -6.6% YoY). The food index grew 3.1% YoY as four of the six major grocery store food indices increased in September. The core inflation, which excludes volatile food and energy and is considered a better gauge of long-term trends by the US Fed, eased to 3% in September from 3.1% in August meeting market estimates.

The US Federal Reserve lowered the repo rate by 25 basis points to the 3.75%-4.00% range in its October meeting to support the slowing labour market. The Fed Chair Jerome Powell said, “I think we are trying to get to the end of this cycle with the labour market in a good place and with inflation on its way to 2% or at 2%.” Fed is likely to announce another round of cut in the December meeting based on labour market indicators; however, the market has fully priced-in the cut.

Disclaimer: The information provided in this article is for general informational purposes only and is not an investment, financial, legal or tax advice. While every effort has been made to ensure the accuracy and reliability of the content, the author or publisher does not guarantee the completeness, accuracy, or timeliness of the information. Readers are advised to verify any information before making decisions based on it. The opinions expressed are solely those of the author and do not necessarily reflect the views or opinions of any organization or entity mentioned.