For those of us who’ve worked across asset classes, through crises and calm alike, the answer increasingly lies in the private credit space. More specifically, in well-constructed Alternative Investment Funds (AIFs) that are deeply rooted in India’s real economy.

Over the past more than a decade, private debt AIFs have evolved from a niche concept into an integral part of India’s capital formation story. What distinguishes them is their ability to generate predictable outcomes in an otherwise unpredictable environment. Thanks to their low correlation to public markets.

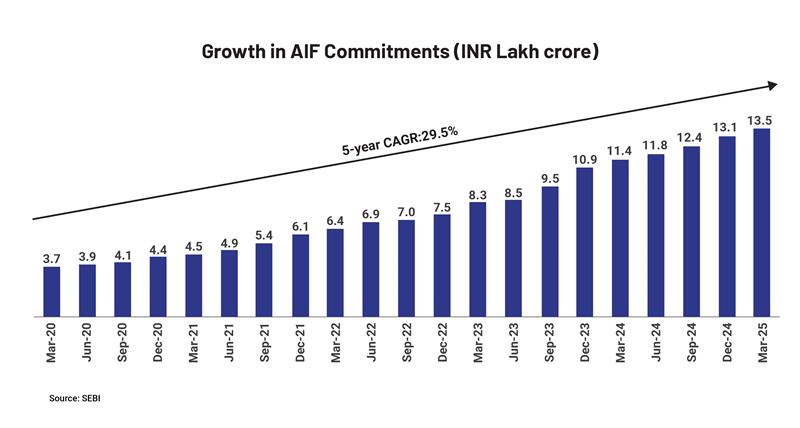

Private debt AIFs can access opportunities that are less susceptible to macro shocks. Their portfolio doesn’t need to be marked to market every day, nor does it invite knee-jerk redemptions in the face of geopolitical risk, in the end, stability matters. It is for these reasons sophisticated investors (HNIs, UHNIs, family offices) in India are reallocating steadily into AIFs as depicted by the exponential growth in commitments, which denotes the amount clients are willing to invest in AIFs.

Disclaimer: The information provided in this article is for general informational purposes only and is not an investment, financial, legal or tax advice. While every effort has been made to ensure the accuracy and reliability of the content, the author or publisher does not guarantee the completeness, accuracy, or timeliness of the information. Readers are advised to verify any information before making decisions based on it. The opinions expressed are solely those of the author and do not necessarily reflect the views or opinions of any organization or entity mentioned.